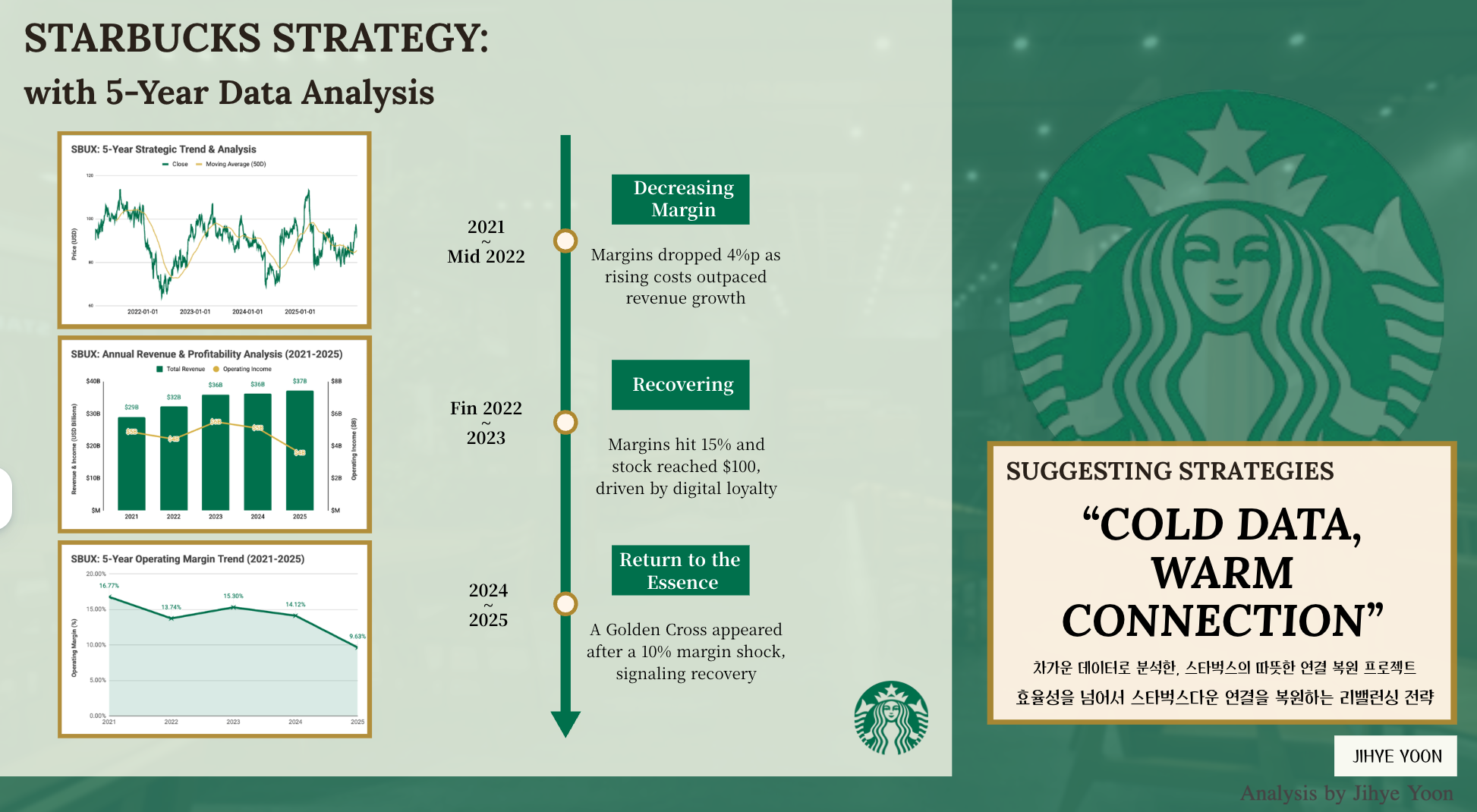

Why Starbucks, Why Now?

"In gaining speed, what did we lose?"

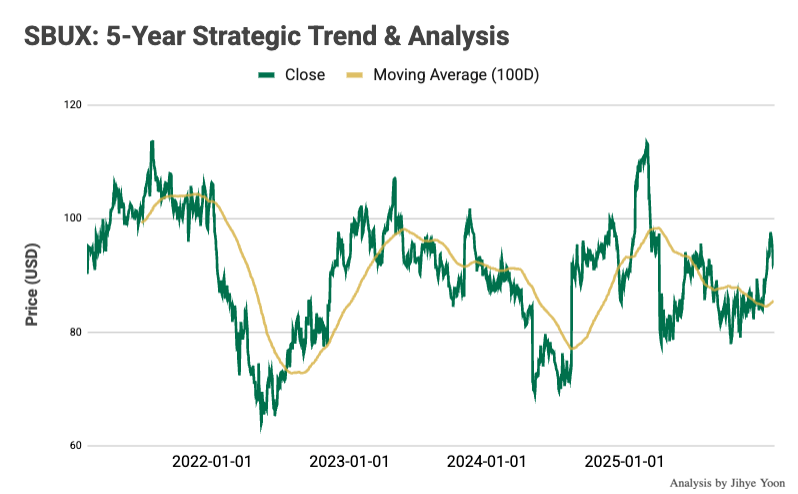

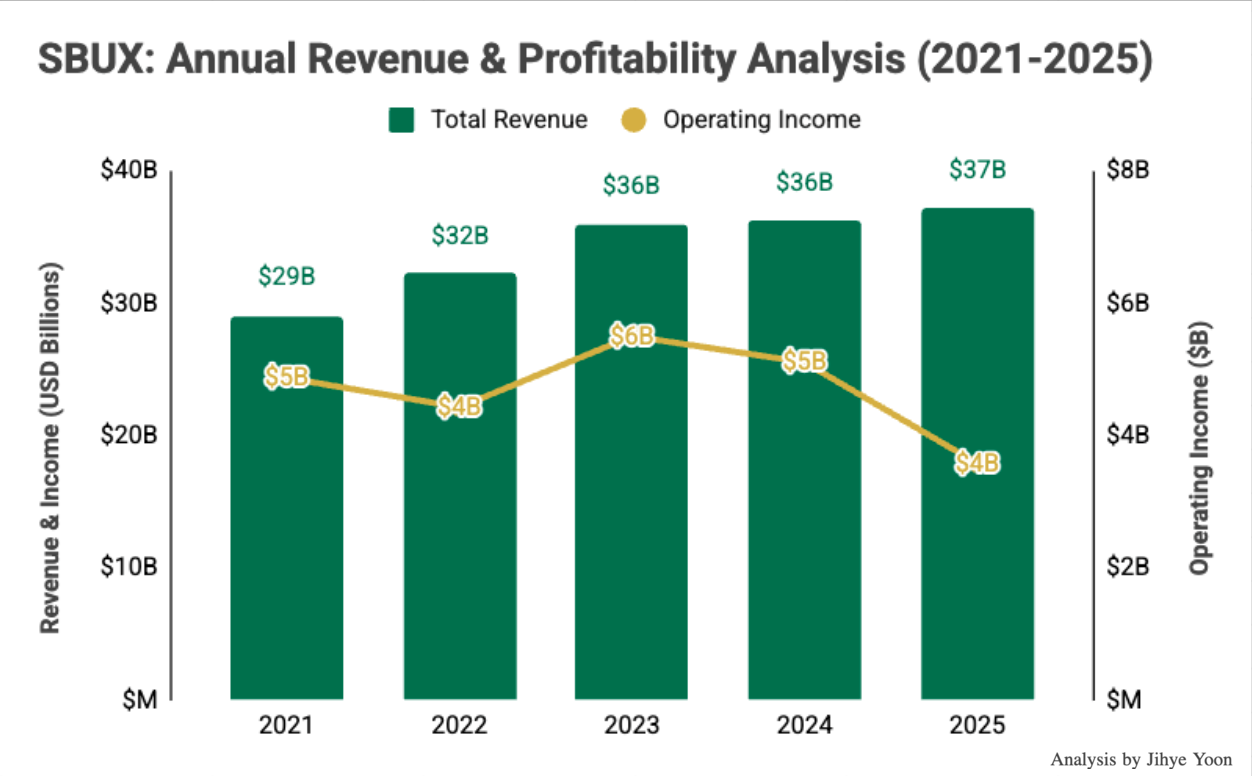

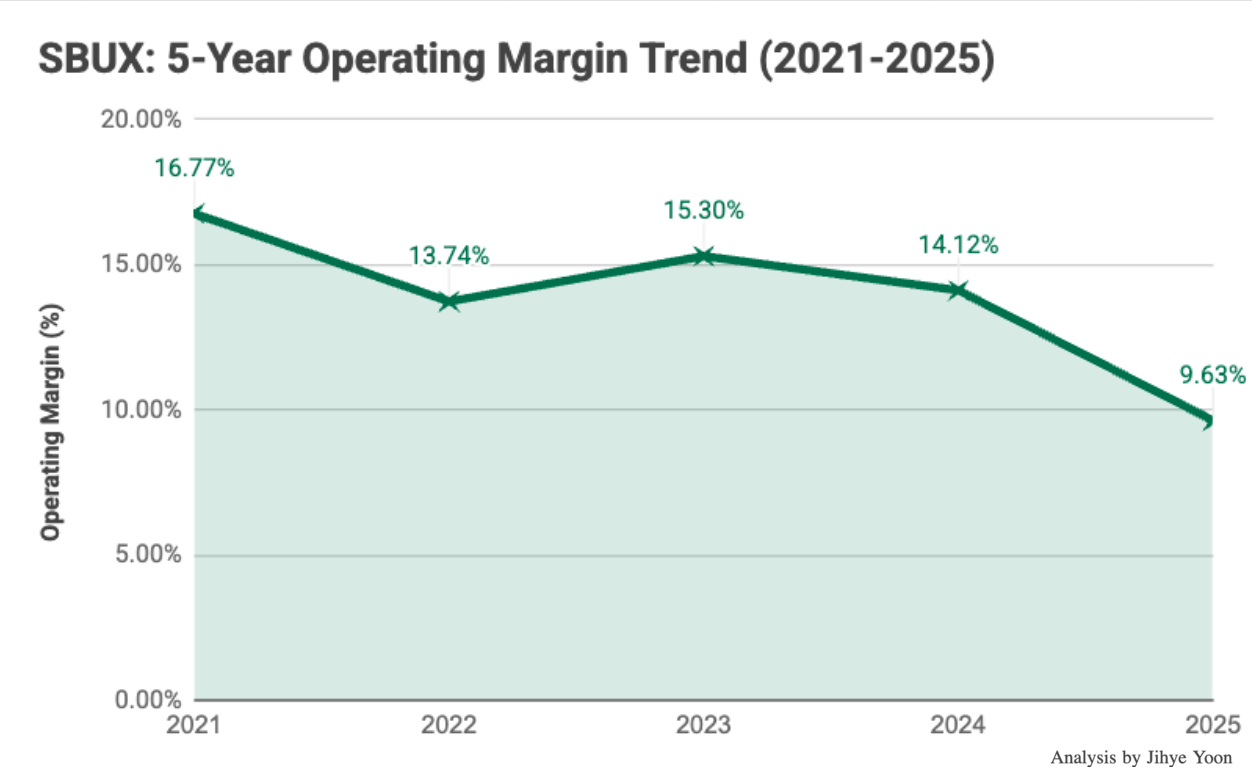

"More stores, faster orders." The efficiency and speed that Starbucks has pursued have become a double-edged sword. Despite record-breaking revenue, declining operating profit margins and stock price volatility force us to ask critical questions.

This analysis diagnoses Starbucks' crisis through Cold Data (quantitative analysis) using Python and Excel, and proposes strategies to restore the brand's essence: Warm Connection (emotional engagement).